Today, we’re discussing the six steps of business forecasting and how it can help you make better business decisions, even when times are tough.

What is Forecasting?

Financial forecasting is the practice of projecting a company’s financial future. It does this by analyzing historical data like revenue,expenses and cash flow. . While it involves educated guesses and assumptions based on the best available data at a point in time, it’s a crucial tool for navigating uncertainty.

The importance of financial forecasting lies in its ability to inform critical business decisions. From hiring to predicting revenue and strategic planning, forecasting equips businesses with valuable insights. It also fosters a proactive, future-oriented approach to financial management.

Do not expect perfection in your forecasting.

Forecasting is imperfect because businesses are always changing, and economic conditions are always shifting.

Can you tell the future with forecasting?

Somewhat if all factors are not changing. However, businesses and economies are constantly changing, so you and your business must be adaptable.

Forecasting allows you and your business to stay agile and adaptable in ever-changing situations, providing you with options and guiding your future actions. .

As a founder, you have to be ready to deal with uncertainty.

If you expect to nail every forecasted goal, you’re setting yourself up for disappointment.

You won’t hit every target, but it’s important to stay flexible and adjust quickly to whatever comes your way.

Forecasting isn’t solely about money; it’s a way to strategize how your business will grow while staying true to what matters most to you and safeguarding your business mission.

By using forecasts, you can look at different scenarios, see how different choices might play out, and make decisions based on facts that fit your business goals.

Think of forecasting as your strategic roadmap, guiding you through uncertainty while safeguarding your mission and steering you towards your long-term goals in an ever-evolving world.

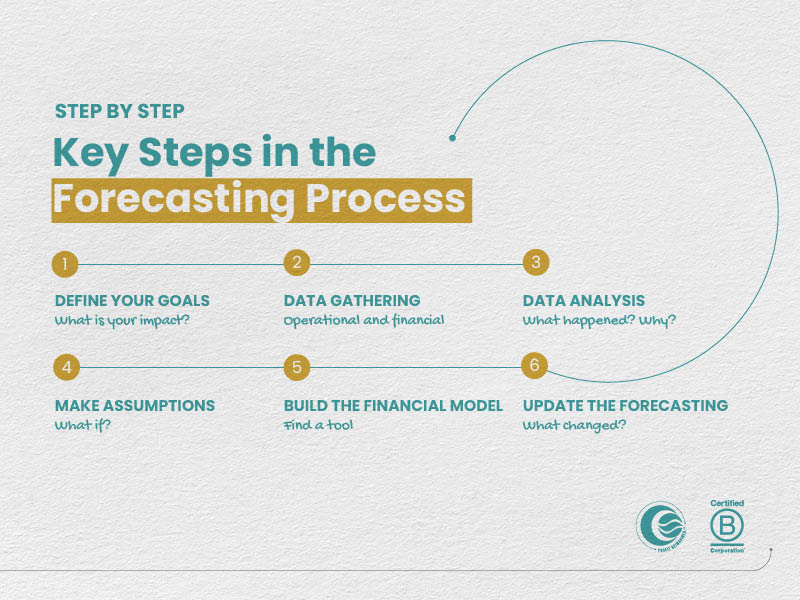

Key Steps in the Forecasting Process

Step 1: Define your Goals

Intentional and purposeful forecasting starts being clear with your objective and impact. This will be the core of everything you do. Take some time to think about what impact you want to improve or what new impact you want to create in the future.

“You want to start with your impact first, because you will prioritize accordingly, because it grounds you to go back to why you started this business in the first place.”

Once you gain clarity on the impact and the corresponding metrics you want to achieve, here are some questions to help you move forward:

- What kind of investments are needed to achieve the impact metrics?

- How does your impact metric affectpricing?

- Do you have the capacity — staff capabilities, and number of staff, to produce the impact metrics?

- Is your business model aligned with your impact metrics?

Step 2: Data Gathering

In general, there are two main categories of data. These are financial and operational data.

Your financial data will show your current gross margin, operating fixed costs, net profit, and working capital position. Financial is not enough, you also need to know your operational data which includes customer acquisition costs, total number of leads, customer conversion rate, customer lifetime value, average revenue per customer production capacity, inventory turnover, and accounts receivable turnover.

Step 3: Data Analysis

Data is useless if you don’t understand the story behind the data. You have to analyze it so the data reveal the story. Only then, you can make informed decisions, identify opportunities and challenges, and also measure your progress overtime.

Start understanding your data by using the following questions:

- What happened?

- Why did it happen?

- What possible outcome do you want to happen in the next 12 to 18 months?

- How can you make it happen without compromising your value?

Step 4: Make Assumptions

Now, you can start forecasting with more details. This is similar to the previous step’s question of “what possible outcome do you want to happen in the next 12 to 18 months” but more detailed and specific. This is the time to combine the historical data with the assumptions about the future.

Assumptions can be as simple as increasing the wages of your employees by a certain percentage or achieving climate neutrality. These assumptions will lead to other important business decisions.

For example:

- Increasing wages may mean adjusting prices or reducing other expenses.

- Achieving climate neutrality may mean carbon offsetting, you will then need to further assume how much you need to offset to achieve your goal.

Step 5: Build the financial model

This is where the fun begins. Building a financial model where art and science come together. You are taking all the data and assumptions, using them to build the future you envision.

A financial model is combining historical data and the expectation of the future to what is possible. Either you can build a financial model using Excel or you can input your data into a financial forecasting tool.

Don’t know where to start?

You can check out a recent interview we had with Jirav.

Step 6: Update the Forecasting

Most people will stop at step 5 and forget all about step 6 which is regularly updating the forecast.

“Remember, a forecast is a living document that improves over time and when used correctly, allows you to recognize early on if your predicted figures are off.”

It’s not enough to build a financial model if you don’t review it against the actual result. A business is never static, so you need to understand why the actual result is not close to the forecast. If you don’t dig deeper to the why, you don’t know when to pivot to a new strategy.

The key to forecasting is not only about building the model, but to understand the result.

The Power of a Fractional CFO for Enhanced Forecasting

While a solid understanding of the forecasting process empowers you to build your own financial roadmap, navigating the complexities of data analysis, model selection, and interpretation can be daunting, especially for mission-driven businesses with unique goals. This is where a fractional CFO steps in as your strategic financial partner.

A fractional CFO offers the expertise of a full-time CFO on a part-time basis, making it a cost-effective solution for businesses seeking to elevate their forecasting capabilities.

You might be wondering

Do I need a Fractional CFO?

Our free quiz helps you identify if our services, extending far beyond bookkeeping, can unlock hidden financial potential in your company.

Here’s how a fractional CFO from Profit Reimagined can specifically enhance your forecasting process:

- Data Powerhouse

They can assist in gathering and cleaning relevant data, both historical and market-based, ensuring your forecasts are built on a solid foundation._ - Modeling Expertise

Leveraging their financial knowledge, they can help you choose the most appropriate forecasting method considering your specific goals and data availability. - Scenario Planning

Together, you can explore various “what-if” scenarios, allowing you to proactively plan for potential market shifts and ensure your social impact mission remains on track. - Interpretation & Insights

A fractional CFO goes beyond generating a forecast. They will analyze the results, identify trends and potential risks, and translate complex data into actionable insights tailored to your mission-driven goals.

By partnering with a fractional CFO, you gain a valuable ally who can streamline your forecasting process, increase accuracy, and ultimately empower you to make data-driven decisions that drive sustainable growth and maximize your social impact.